Nium Resources Hub

Explore Our Content

Nium, the global leader in real-time, cross-border payments, today announced it is now registered as a Financial Services Provider in New Zealand.

The Fintech Marketing Hub, in partnership with Innovate Finance, released its 4th edition of “Fintech’s 30 Most Influential Marketers.” The list celebrates marketing excellence and innovation, with honorees from globally renowned fintech brands.

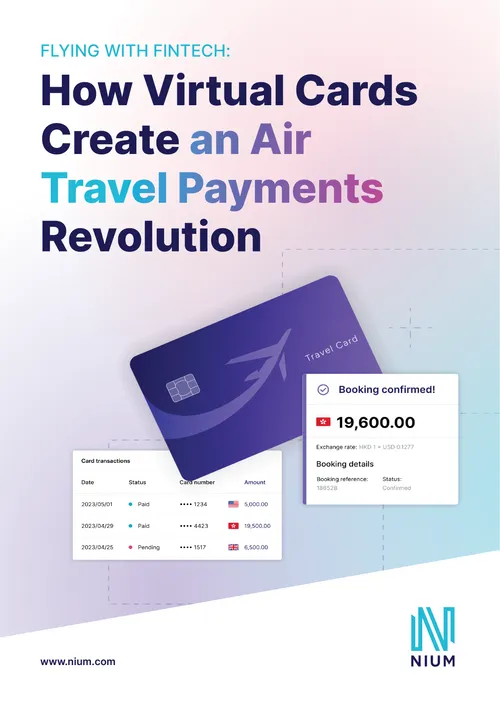

Nium, the leader in real-time cross-border payments, today announced its partnership with luxury tour operator Scott Dunn to issue virtual cards to its global network of hotel providers.

Weel’s partnerships with Nium and Visa provides a strong foundation for Weel to take its highly successful product offering to overseas markets. Nium’s end-to-end solution and licensing in over 40 markets, coupled with Visa’s acceptance in over 200 markets, will enable Weel to pursue a faster go-to-

With Nium as its strategic partner, OZ has greatly sped up global payments so they take just minutes – typically in the same amount of time it takes to enjoy a Brazilian espresso. In addition to speedy payments, OZ and its growing list of customers benefit from automated compliance, added transparen

April 23 - 25, 2024

Connect with Nium at Money20/20 Asia: on the show floor, in panel sessions, or at the Nium @ Nite party. Request to speak with one of our experts, and discover how Nium’s single API empowers banks, FIs, marketplaces, and enterprises to move money across 190+ countries.

.png)